Can I Get Money Back On Safeco Insurance If I Cancel

Concluding Updated July 26, 2021

There'south no reason to stick with a machine insurance policy you lot're not satisfied with.

Maybe you weren't happy with how Safeco handled your last claim. Maybe you'd like a policy with more coverage options, such as roadside assistance. Or mayhap y'all'd like to go a ameliorate rate. If you're a Safeco client, you can cancel your policy at whatever fourth dimension.

Information technology'southward smart to shop around for a new auto insurance policy every six months. You won't know which insurance provider will give you the all-time rates until you get customized quotes. With Insurify, you can compare auto insurance premiums for different types of coverage in one place, so you lot won't have to do any busywork.

Once you lot've narrowed down your options, look into customer satisfaction scores before making a determination. A depression rate is certainly appealing, only you'll desire to brand sure your provider volition exist easy to work with in the result of a machine accident.

Compare Car Insurance Quotes Instantly

- Personalized quotes in 5 minutes or less

- No signup required

At a Glance: What is Safeco's cancellation policy?

Safeco, like virtually motorcar insurance companies, has a flexible counterfoil policy. At that place are no fees for canceling your Safeco policy, and you'll typically get a refund of the prorated corporeality if y'all prepaid your premium.

But before y'all call your Safeco insurance agent to abolish your policy, you lot should follow these steps to ensure you don't accept a lapse in insurance coverage.

Pace 1: Wait up your renewal date.

Information technology's usually best to cancel your policy close to the renewal engagement. You won't have to worry near being eligible for a refund or waiting for the check to make it. Y'all tin find your policy details in your online business relationship at safeco.com or call your Safeco agent to enquire for your renewal appointment.

Information technology's also important to know your renewal engagement and so yous don't have a lapse in coverage. You'll want to make sure you've found a new policy before your Safeco policy renews.

Step 2: Compare car insurance quotes.

If you want to get the best bargain, you'll need to get customized quotes from a multifariousness of insurance companies. But it can be difficult to compare coverage options apples-to-apples, not to mention time-consuming to get quotes from individual insurance companies.

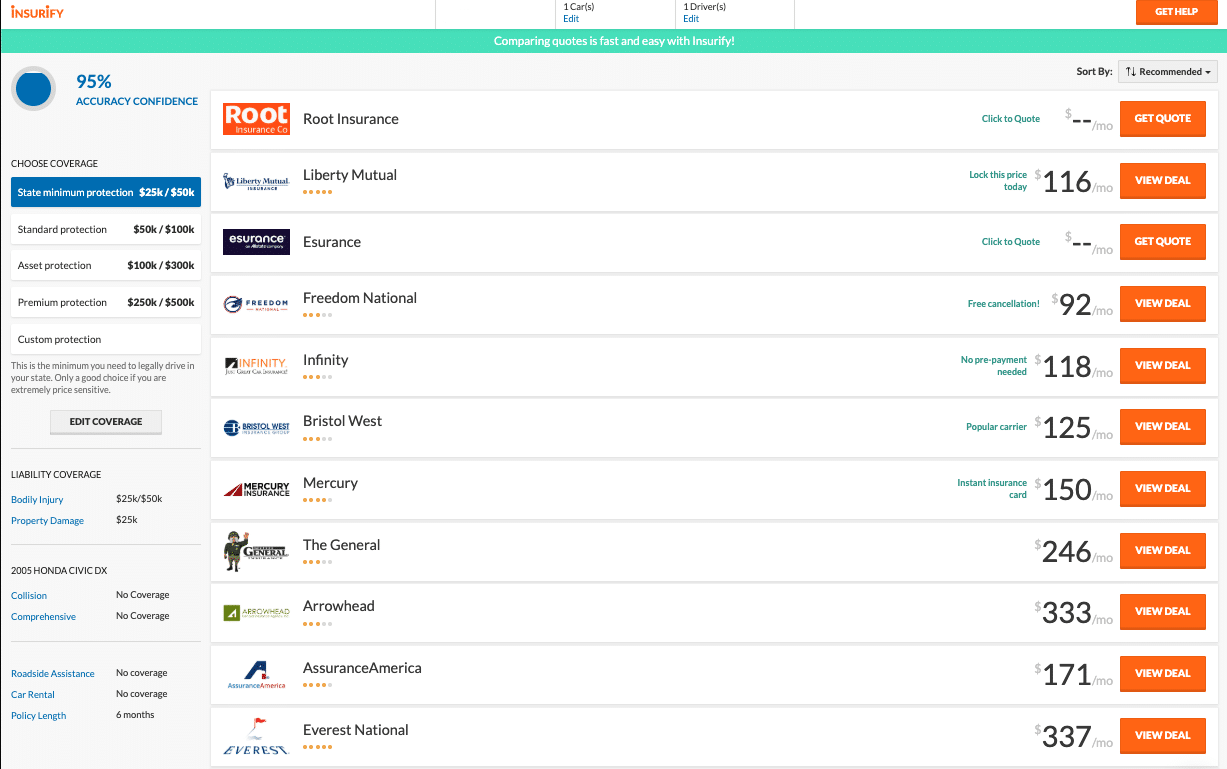

With Insurify, y'all can ditch the spreadsheet method of comparison shopping and view free auto insurance quotes from up to 20 dissimilar insurance providers all in one place. You lot'll only need to enter some bones information about your vehicle and driving record to get started.

Consider the type of coverage you lot'll demand when selecting the correct insurance policy for you. Insurify makes information technology like shooting fish in a barrel to toggle between unlike types of coverage, so yous can see which providers offer the coverage yous need at the lowest charge per unit.

Safeco Quotes vs. Competitors

To give you an idea of what Safeco's competitors charge for car insurance, hither is a list of average quotes from our proprietary database:

Comport in listen that these quotes are based on averages. To observe out how much other companies would charge you for car insurance, use Insurify. Insurify allows you to compare customized car insurance quotes from upwards to 20 companies at a fourth dimension––for gratuitous!

Pace 3: Retrieve most why you lot're leaving Safeco.

Exercise you just want a lower rate, or were yous unhappy with Safeco's client service or claims process? It's important to place the source of your dissatisfaction so that you don't finish up with some other policy that doesn't meet your needs. If customer service was an outcome for you, you'll want to do some enquiry into customer satisfaction scores for other machine insurance companies.

Step 4: Enroll in a new automobile insurance policy.

It's important that you don't let your current policy expire before signing up for a new 1. You'll exist charged a hefty DMV insurance lapse fee if y'all go without coverage. What'south more, it's illegal to drive without car insurance in almost every state. If yous're caught, you'll face even more fines.

To enroll in a new machine insurance policy, showtime past inbound your data with Insurify. From there, y'all'll be able to see customized insurance rates that include any discounts you may be eligible for, such as bundling your policy with your homeowners insurance or having an anti-theft device. Select the policy that'southward right for y'all and go on to enrollment.

Footstep five: Abolish your Safeco insurance policy.

To cancel your Safeco auto insurance policy, you'll need to call your local agent. If yous tin can't reach them, you can as well telephone call 1 (800) 332-3226 for help. Have your policy number ready to provide to the representative.

Subsequently you request the cancellation of your policy, you may exist asked some follow-up questions. But answer honestly. Once the representative has successfully canceled your contract, ask for a confirmation e-mail.

It'south possible Safeco could offer you a lower rate if you stay. If the rate was the reason you lot were canceling, this could be plenty to convince yous. Just make sure you lot can abolish your new policy without penalty. On the other mitt, if you lot were dissatisfied with the customer service, you'll probably want to proceed with canceling your Safeco policy.

Step half-dozen: Follow upwardly on your refund.

If yous were eligible for a refund on your current policy, set a reminder to follow up if you still haven't received information technology in a month. Information technology tin can take 2 to four weeks to get your cheque in the mail.

Browse, Compare, Find with Insurify today.

Compare Motorcar Insurance Quotes Instantly

- Personalized quotes in 5 minutes or less

- No signup required

Methodology

The auto insurance quotes displayed are based on an analysis of Insurify'southward database of over 40 million quotes from 500 ZIP codes nationwide. To obtain representative rates, Insurify's data science team performs frequent comprehensive analyses of the factors car insurance providers counterbalance to summate rates including driver demographics, driving record, credit score, desired coverage level, and more.

Insurify'due south analysis likewise incorporates the Insurify Composite Score (ICS) assigned to each insurance provider. The ICS is a proprietary rating that weighs multiple factors reflecting the quality, reliability, and wellness of an insurance visitor. Ratings used to summate the ICS include Financial Strength Ratings from A.M. Best, Standard & Poor's, Moody'due south, and Fitch; J.D. Power ratings; Consumer Reports customer satisfaction surveys and client complaints; mobile app reviews; and user-generated company reviews.

With the above insights and ranking methods, Insurify is able to offering motorcar insurance shoppers insight into how various insurance providers compare to one another in terms of both cost and quality. Note, bodily quotes volition vary based on unique attributes including the policyholder's driver history and their garaging address.

![]()

Content Writer at Insurify

Lindsay Frankel is a content writer specializing in personal finance and automobile insurance topics. Her piece of work has been featured in publications such every bit LendingTree, The Balance, Coverage.com, Bankrate, NextAdvisor, and FinanceBuzz.

Larn More

Source: https://insurify.com/blog/car-insurance/cancel-safeco/

Posted by: martinezishaves.blogspot.com

0 Response to "Can I Get Money Back On Safeco Insurance If I Cancel"

Post a Comment